In recent times, the global economy has witnessed an unprecedented surge in inflation, largely due to the far-reaching effects of the Covid-19 pandemic. At Cooee Wealth Partners, we understand the concerns that investors and individuals alike may have about the impact of high inflation on their financial well-being. In this blog, we delve into the reasons behind the current inflationary environment, the role of raising interest rates in curbing inflation, and practical strategies that individuals can employ to safeguard their finances.

Understanding High Inflation

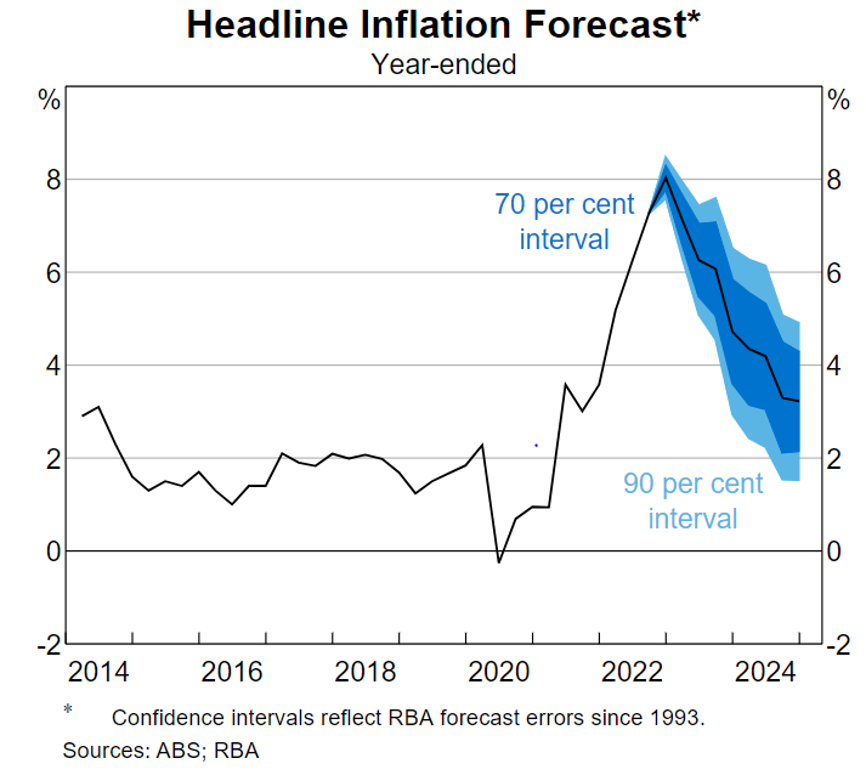

The Covid-19 pandemic triggered a cascade of economic disruptions, causing supply chain bottlenecks, labour shortages, and increased production costs. These factors, when coupled with pent-up consumer demand as economies reopened and loose monetary policy, fueled a surge in prices for goods and services. This phenomenon, known as inflation, can erode purchasing power and disrupt financial plans. As a result, headline inflation peaked at 7.8% in December 2022 but eased to 6.0% by June 2023:

The Role of Raising Interest Rates

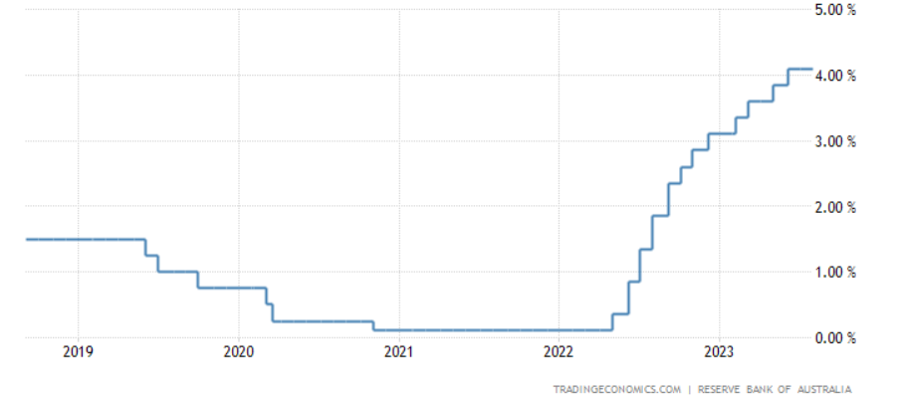

Central banks, including the Reserve Bank of Australia, often turn to interest rate adjustments as a tool to manage inflation. When inflation is high, raising interest rates can help rein in spending and borrowing, thereby reducing overall demand. This, in turn, can help stabilise prices and prevent runaway inflation. However, the decision to raise interest rates is a delicate balancing act, as it can impact economic growth and borrowing costs. Since beginning the monetary tightening cycle in May 2022, the Reserve Bank of Australia has lifted rates by a total of 400 basis points:

Interest Rate Outlook

About inflation, outgoing Reserve Bank Governor Phillip Lowe recently stated “We’ve made progress here, and things are moving in the right direction, but it’s still too early to declare victory,”. Inflation still has a long way to fall before it sits comfortably within the target range of 2% to 3% per annum, which the RBA is forecasting will be achieved in late 2024:

More positively, three of Australia’s big four banks have forecast that we’ve reached the peak of interest rates:

| Bank | Rate Peak |

|---|---|

| CBA | 4.10% |

| ANZ | 4.10% |

| Westpac | 4.10% |

| NAB | 4.35% |

CBA, Westpac and NAB also predict that we’ll see interest rate cuts in 2024 at the earliest and 2025 at the latest.

Strategies for Combating Rising Costs and Higher Interest Rates

- Refinancing Your Mortgage

- Refinancing Your Mortgage

- Review Investments

- Exploring Fixed-Income Investments

As interest rates rise, it might be an opportune time to explore refinancing your mortgage. By securing a lower interest rate, you can reduce your monthly mortgage payments and potentially save a substantial amount over the life of the loan.

Review your cash flow structures and identify areas where you can cut unnecessary expenses. Allocating funds towards essential needs and long-term goals, such as retirement and education, can help you weather the impact of rising costs.

The rise and fall of interest rates can have a substantial impact on investor sentiment and market behaviour. As interest rates climb, the cost of borrowing increases, which can lead to decreased business investments and spending. This, in turn, might result in reduced corporate earnings, influencing stock prices. On the flip side, lower interest rates can stimulate borrowing and spending, potentially boosting economic growth and lifting stock values. Understanding this intricate dance between interest rates and the stock market is fundamental for investors. Within our model portfolios, we have a bias towards businesses with lower borrowings and higher free cash flow.

Fixed-income investments, such as bonds, can provide a steady stream of income and serve as a buffer against market volatility. Consider incorporating these into your portfolio to enhance stability. Current fixed-income yields are at their most attractive levels in over a decade.

Conclusion:

In a world of heightened inflation and rising interest rates, adapting and proactively managing your finances is essential. Cooee Wealth Partners are here to assist you in navigating these challenges and seizing opportunities for financial growth. By refinancing mortgages, optimising cash flow, diversifying investments, and staying financially informed, you can take significant steps towards securing your financial well-being amidst these dynamic economic conditions. Remember, a well-crafted financial strategy is your compass to weathering uncertainties and achieving your long-term goals.