Navigating the world of business, finance and work can be a daunting task. Some weeks it feels as though all we do is work, grinding away day in and day out in the hope that one day we will be able to retire comfortably. Of course, the current cost of living doesn’t promote confidence. Some days it feels as though the harder you work, the harder you are slugged with taxes, fees and costs. Sound familiar? It’s no surprise that at the end of the work week, you want to be able to enjoy your spoils – to relax over a nice bottle of wine; take your partner out for a night on the town; splurge here and there on the things that bring you additional joy. At the end of the day, all most of us want is to be able to enjoy our life. The thought of sacrificing this for long-term gain can be disheartening. No one wants to work hard, only to squirrel away every cent for future retirement. According to experts in the field of finance, it is possible to ensure you are set up for the future without giving up everything now. Put simply, it comes down to balance. Just ask our Head of Wealth, Andrew Grinsell, who says that making small adjustments now can prevent the need for massive lifestyle changes in the future. “Most people haven’t considered what they need to be doing today to set themselves up for the future,” Andrew says. “There’s a perception that financial planning is all about budgeting and making sacrifices when in reality it’s more so focused on implementing strategies that balance a person’s needs and wants of today with those of the future.”

What happens when you maintain an unsustainable lifestyle?

We all do it – dream of a ‘better’ life. Of a newer home, of a bigger boat, of a luxurious holiday in Bora Bora. We’re financial planners, and even we do this! The only difference is that as experts we understand the risks associated with maintaining an unsustainable lifestyle. Better yet, we know how to remedy those risks. Prioritising today’s wants with zero regards for future needs can result in a substantial lifestyle shock for people. This can arise in many ways. Let’s break it down a little more…

- Debt. Once credit cards are maxed out, there’s no capacity to continue spending more than you earn, and risks of late payment and bad credit ratings arise in addition to being stuck in a debt trap that takes years to escape.

- Sacrifice. People arrive at retirement without adequate preparation, resulting in a substantial lifestyle cut once their employment income ceases. Adjusting to living on the Age Pension can result in a lot of sacrifices, which far exceed the sacrifices that are needed if someone starts planning early.

Picture this: For the past 20 years, you have enjoyed a $150,000 salary – twice yearly overseas holidays, dining out regularly, being able to afford new cars and easily paying your bills. Now imagine that income ceasing to exist. Your only form of income is now the government-supplied Age Pension, which provides income support for Australians aged from 66 to 67 years of age. Each recipient must meet set criteria and conditions, taking into account if you are partnered or single, as well as any assets you may own. The maximum fortnightly payment for a single pensioner is $1,064. That equates to only $27,664 a year. It’s a big difference to the life you have become accustomed to. For many Australians, spending extravagantly is not a lifestyle that is sustainable. For others, their lifestyle is non-negotiable, which means smarter planning is needed. Regardless of your situation, it is important to plan for and create a lifestyle that you can maintain and enjoy.

Case study: Quality lifestyle versus limited wealth

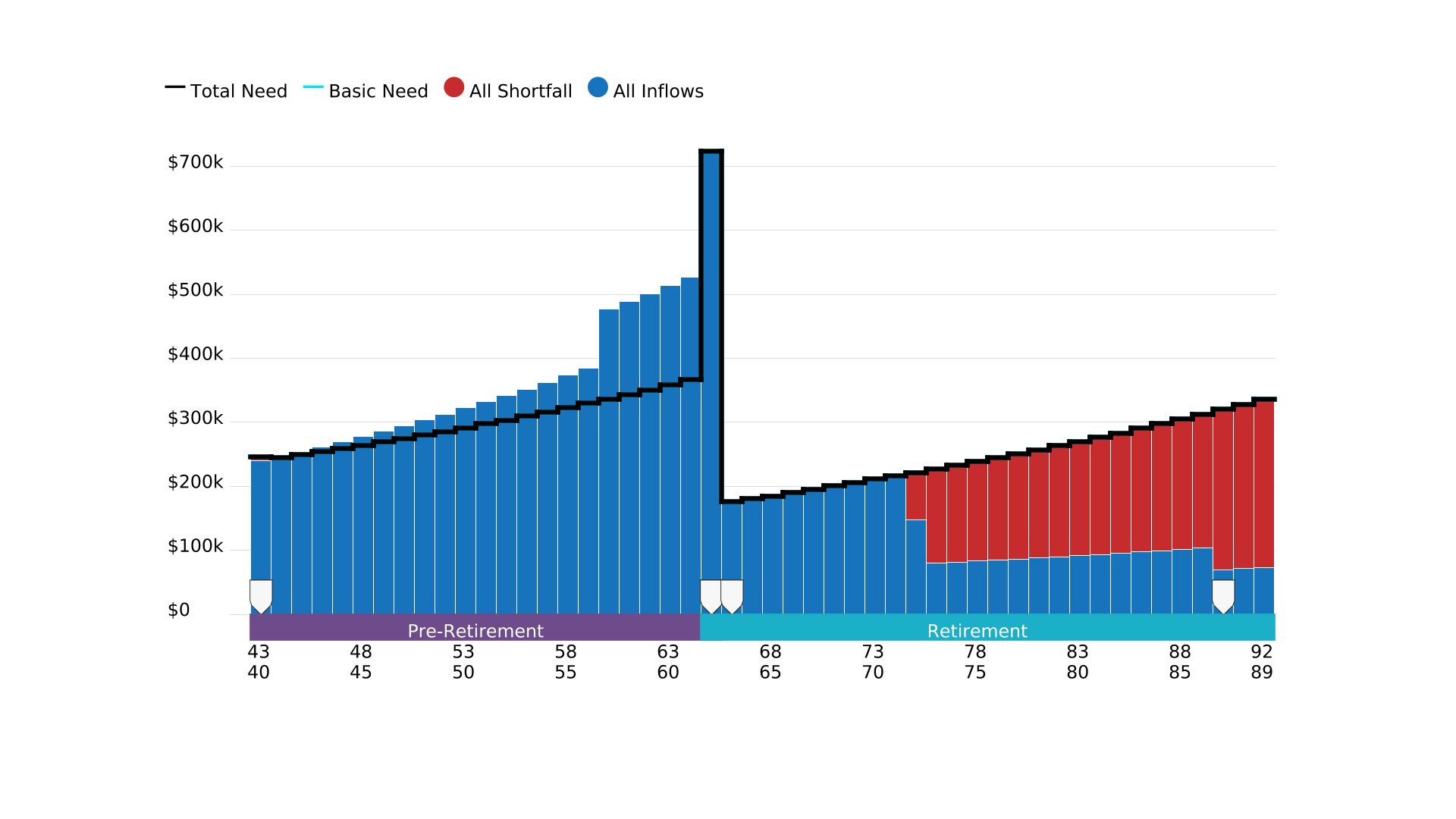

Let’s take a look at one successful couple. For the sake of the story, let’s call them Chris and Candice*. Chris is a 43-year-old full-time employee who earns a high income of $160,000 per year. His wife is also employed full-time, earning $80,000. Life has treated them relatively well. They work hard and have a beautiful home worth $1.3 million. They also have a debt of $1 million, and annual living expenses of $100,000. The couple has identified their ideal retirement ages – 65 and 63 respectively. They also know exactly what they would like their retirement income goal to be – a whopping $100,000 a year. With super balances currently sitting at $90,000 and $65,000, it’s fair to say they have a long way to go to achieve their dream. Given that the cost of living in retirement in Australia ranges from around $44,000 per year up to $68,000 per year for a couple, it is important to have a clear understanding of what your future plans entail. The ASFA Retirement Standard predicts that for a comfortable retirement, covering house repairs, occasional trips, a good car, regular activities and daily living costs, a couple aged 65 to 84 will require $68,014 a year. Singles can expect to spend around $48,266 a year. Meanwhile, couples seeking a more modest retirement (with less discretionary spending), will require an estimated $44,034. Singles will need around $30,582 a year. Calculations show that if they continue on the path they are on, and after withdrawing some super to pay off their remaining home loan at retirement, Chris and Candice will be able to sustain their $100,000 per year retirement expenses for only 10 years. They will then be forced to accept the Age Pension of $38,079 per year for the remainder of their lives. You don’t have to be a mathematician to see that this pension income is a huge reduction in their usual earnings. We’re talking about a $62,000 reduction in lifestyle – per year.

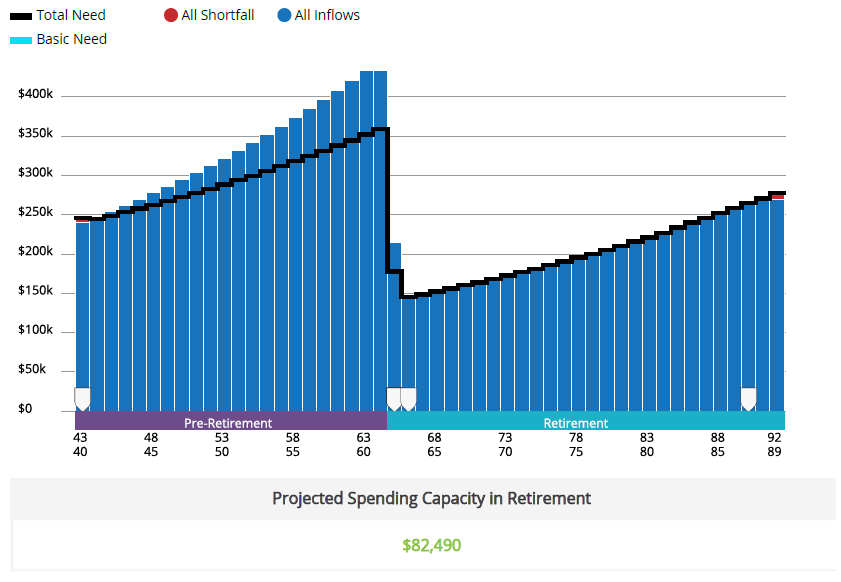

Of course, there is always an alternative option. The first is opting to accept a reduced income from the start of their retirement. The couple could choose to live off a flat rate income of $66,318 annually from retirement date to age 90. The second option is more palatable. Think about this: If they could cut $10,000 per year from current living expenses and put this towards home loan reduction, the couple could sustain their $100,000 per year of retirement income for 20 years before reverting to the Age Pension. Alternatively, they could maintain a flat rate of income in retirement of $82,490 per annum from their retirement date to age 90.

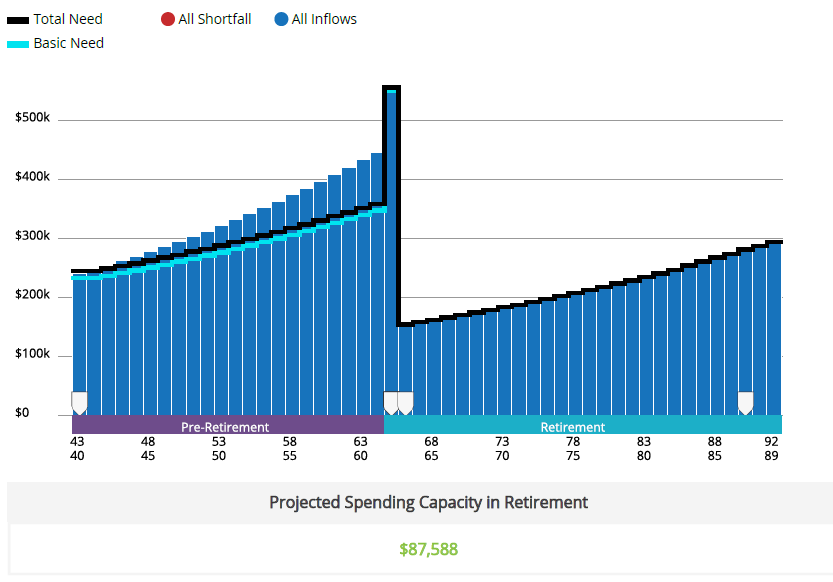

Furthermore, if they choose to salary sacrifice to super to reduce their take-home pay by $10,000 per year, they could sustain $100,000 annually in retirement for 21 years before reverting to the Age Pension. Alternatively, they could maintain a flat rate of income in retirement of $87,588 per annum from their retirement date to age 90. These figures are well above the currently expected retirement costs.

As you can see, there are always options. You just need to be willing to learn, plan and set achievable goals.

Why a financial advisor can help

Finding the right financial adviser and embarking on the path to monetary success can be overwhelming if you don’t have a thorough understanding of how a planner can assist. Choosing the right financial planner is important as you need to feel confident and comfortable with their practices and advice.

Andrew & Catherine’s Story

A reliable financial adviser will help you determine your needs – are you seeking general advice, comprehensive advice or ongoing advice? Your advisor can help you determine what will work best, and then help you create a plan to achieve your set goals. A good adviser will be able to provide you with resources and outline how they work with you. At Cooee Wealth Partners, there are key steps we work through and a range of comprehensive services available.

|

|

|

|

|

|

|

|

|

|

At the end of the day, the lavish lifestyle you’ve been keeping could cost you more when the time comes. Do you know exactly what you need in retirement, and how to achieve it? Book an appointment with us to get you back on track.